IRS Gearing Up to Shut Door on Huge Discounts

The window may be rapidly closing for wealthy families to take advantage of valuation discounts when transferring interests in family entities. At the American Bar Association’s Section of Taxation meeting in May, IRS tax attorney, Cathy Hughes, signaled the Service’s intent to release new proposed regulations under Internal Revenue Code (“IRC”) Section 2704[1] by mid-September.[2] These proposed regulations would likely curtail certain valuation discounts of interests in family entities.[3]

A long-time estate and gift tax (“transfer tax”) planning strategy implemented by “wealthy” Americans who would otherwise be subject to federal transfer tax liability on transfers of assets during their lifetime or upon death (i.e., individuals with taxable estates that exceed the exemption amount which is currently $5.43 million), is to attempt to minimize the tax impact of such transfers by employing various discounting methods to reduce the value of such transferred interests. Taxpayers successfully use these discounting techniques to reduce the gift tax value of assets transferred from family entities by 25 to 40 percent, leading to steep reductions of transfer tax liability.

Discounting Theories:

- Lack of Marketability: One type of discounting theory is based upon the transferred interest’s lack of marketability. This principle is rooted in the fact that there is no ready market for the interest being transferred, because of restrictions typically found in governing agreements relating to minority owners. Because the interest owner is not guaranteed ready access to a purchaser in the event he or she wishes to sell the interest, therefore, the value of the interest cannot be determined on a pro-rata basis to the value of the whole and must be discounted.

- Lack of Control: This concept is based on the fact that the transferee does not control the entity in which the interest is held. This is usually accomplished by designating the transferee as a limited partner or non-managing member in the entity.

Proposed Regulations:

The new proposed regulations, which would be sanctioned under IRC Section 2704(b)(4).[4] would expand the current scope of Section 2704 by disregarding additional restrictions found in the governing agreements of family entities, thus disallowing many of the valuation discounts, including the two described above, typically used when appraising transferred interests in family entities.

It is important to note, that most likely, the proposed regulations would not affect discounting in connection with the transfer of “real” minority interests (i.e., those not held in family entities). This is because Section 2704(b)(4) only grants the secretary power to issue regulations for intra-family transfers.

There is further speculation that under the new regulations, restrictions found in existing family entities would not be “grandfathered-in” to the old (current) rules. Only discounts in connection with the gift or sale transactions of interests in entities that are completed before the effective date of the proposed regulations would be grandfathered in to the old rules.

Blessing in Disguise:

The proposed regulations may actually be advantageous for decedents who do not have an estate tax concern but would benefit from a “stepped-up-basis” at death.[5] Under IRC Section 1014, the basis of assets that a beneficiary receives from a decedent’s estate is calculated for income tax purposes, by the fair market value of the assets at the time of the decedent’s death – a “step-up” from the cost basis of the asset. Since these regulations would “increase” the value of assets by disregarding certain discounts, a beneficiary who inherits a minority interest in a family entity would receive a higher step-up in basis on those assets, leading to future income tax savings upon a later sale or depreciation of the inherited interest.

Illustration:

The graph on the following page illustrates the difference in a lifetime gifting plan with discounting and without discounting, assuming a married taxpayer utilizes 50 annual gift tax exclusions (i.e., through gifting to a “Family Trust” for the benefit of descendants) for a period of 20 years by making gifts of interests in a family entity appraised at $40mm, and assuming a discount rate of 30%.

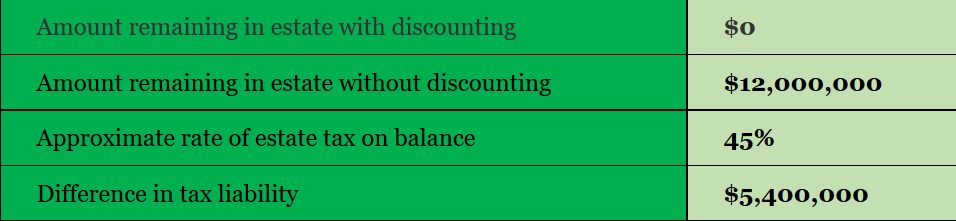

The below table calculates the actual difference in tax dollars in the above example.

Conclusion:

Due to the uncertainty surrounding discounting and the tremendous transfer tax benefit that potentially could be lost, it is therefore recommended, that high-net worth individuals (especially those who have consistently implemented these strategies as part of their annual tax planning) take advantage of valuation discounting by transferring interests in family entities before the new proposals take effect.[6]

* * * * *

Please contact our firm to discuss whether intra-family wealth shifting using valuation discounts is an appropriate strategy for you based on your specific circumstances.

The information contained in this article is for general information purposes only. It is not intended as professional counsel and should not be used as such.

Baruch (Brian) Y. Greenwald and Hillel D. Weiss are the founding members of Greenwald Weiss Attorneys At Law, LLC, a New York and New Jersey based law firm focused on estate planning and related matters. If you have any questions relating to this article or would like additional information regarding estate planning, please visit www.greenwaldweiss.com or contact Baruch (Brian) at (718) 564-6333 or bgreenwald@greenwaldweiss.com, or Hillel at (732) 526-6333 or

hweiss@greenwaldweiss.com.

- [1] Section 2704 was enacted with the goal of limiting discounts for certain interests in family entities that are transferred to family members. For example, the statute provides that certain restrictions found in governing agreements of family entities will be disregarded when valuing interests that are transferred to family members. While the statute disregards certain restrictions, other discounting theories discussed in this article have until this point always been available to taxpayers.

- [2] While the proposed regulations will most likely be released by mid-September, treasury regulations are typically effective only on the date final regulations are issued. Several years generally lapse from the time proposed regulations are issued until the regulations are finalized. However, in certain circumstances, proposed regulations provide that the regulations are effective when finalized retroactive to the date they were originally proposed. In this instance, the IRS is still considering what should be the effective date of the proposed regulations.

- [3] This is defined in Section 2704 as an entity in which the taxpayer and his or her family members (i.e., spouse, ancestor, lineal descendant, spouse of ancestor or descendant, brother or sister) collectively own at least 50% of the interests in the entity.

- [4] This portion of the section gives the treasury very broad authority to issue regulations which would disregard restrictions when valuing interests in family entities.

- [5] Even for estates which would be subject to estate tax liability, there may be some instances where the disallowance of discounting would end up being beneficial, because of the basis step-up.

- [6] See note 2 above for discussion about possible effective date of these new rules.

Recent Comments